CCDC Participation Program

The Participation Program is CCDC’s development assistance program and is designed to advance the aims of urban renewal and economic development in Boise, as well as goals identified for the various neighborhoods in and around the districts as identified in Blueprint Boise. The program has specific goals and scorecards unique to the six districts, and is crafted to be transparent, understandable and responsive in order to encourage private investment. The Downtown Districts policy includes River-Myrtle/Old Boise, Westside, 30th Street, and Shoreline. Gateway East has a separate policy document, as does the newly formed State Street District.

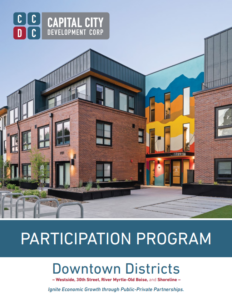

Downtown Districts

Downtown Districts

The Downtown Districts Policy includes the following four districts: River Myrtle/Old Boise, Westside, 30th Street, and Shoreline. The policy focuses on the common goals within each of these downtown districts and surrounding neighborhoods including activating dormant or disinvested sites, expanded utility infrastructure, improved mobility and connectivity for all users, and compact development.

Gateway East District

Gateway East District

The Gateway East Policy aims to encourage and inspire development that supports the district’s original goals to diversify Boise’s economy, create quality jobs, and plan for industrial growth by improving infrastructure and promoting industrial development in and around Boise’s Airport Planning Area.

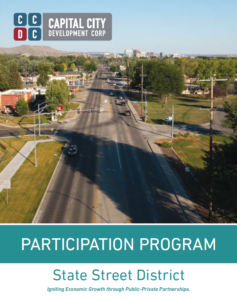

State Street District

State Street District

The State Street District envisions a best-in-class transportation corridor supported by dense, mixed neighborhood “nodes” at key points along the corridor. The State Street Policy encourages transit oriented development that increases connectivity, walkability, and mobility solutions for all users.